Madhuchanda Dey

Moneycontrol Research

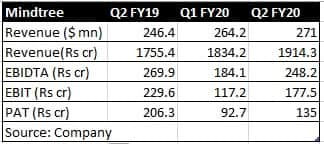

Mindtree’s September quarter (Q2) performance came in better than that of the June quarter (Q1) as efforts of the new management paid off in terms of stability for clients and employees. However, strong revenue performance and margin improvement may have to wait.

We expect single-digit earnings growth in the next couple of years. In this context, the valuation at 14x FY21e earnings leaves room for downside. Hence, investors should accumulate on correction.

Key positives

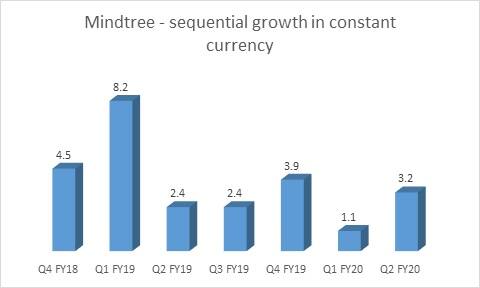

Reported revenue for the quarter at $271 million showed a sequential growth of 2.6 per cent in reported and 3.2 per cent in constant currency. The YoY (year-on-year) growth in constant currency stood at 11.1 per cent.

Source: Company

While the overall revenue growth in reported currency showed a YoY growth of 10 per cent, the digital component of revenue grew much faster at 18.7 per cent, making up 38 per cent of the total revenue.

In terms of verticals, technology & media as well as travel and hospitality continued to show strength.

Turning to geographies, the key market of the US (with 74 per cent share) grew well. India as well as the rest of the world registered a decent show on a relatively small base.

Unlike its peers, Mindtree management did not sound too worried on the Banking, Financial Services and Insurance (BFSI) vertical as its areas of focus have been insurance and tier 2 banks that have not shown stress so far. The management is not too concerned about the slowdown in retail as it has much higher exposure to CPG (consumer packaged goods) side of the business.

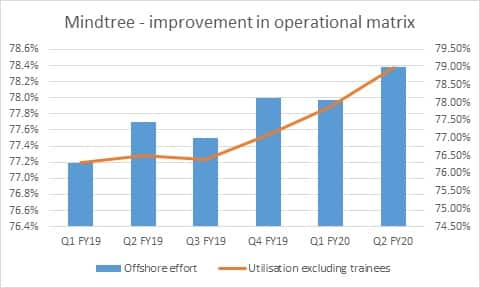

Mindtree reported 40 basis points (bps) of sequential improvement -- excluding the one-offs that impacted margin in the previous quarter -- in EBITDA (Earnings before interest, taxes, depreciation, and amortisation) margin at 13 per cent. While efficiency gains (resulting from better utilisation and higher offshoring) had a 140 bps positive impact, aided by 50 basis points from forex, these were offset by the second cycle of compensation increase that shaved off margin by 150 bps.

Source: Company

Source: Company

Margins came under pressure as some projects were scaled up, resulting in the company incurring costs that did not generate revenue. The revenue recognition in coming quarters from these projects should give a fillip to margins. The management expects steady improvement in margins in coming two quarters.

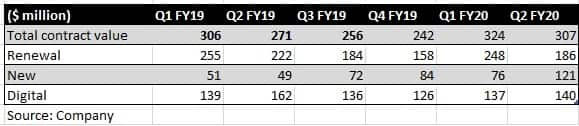

Deal win momentum was strong. Mindtree bagged deals worth $307 million. New CEO Debashish Chatterjee has met all the key clients of Mindtree and the feedback is positive.

Key negatives

The quarter witnessed 4.2 per cent sequential decline in realisation and part of it could be explained by higher offshoring.

In terms of geographies, Europe was weak.

While the management guided for margin improvement, it sounded sceptical about its ability to hit Q4FY19 EBITDA margin of 15.2 per cent in the next couple of quarters.

Similarly, while the revenue momentum is better in Q2, the management remained non-committal on the revenue acceleration in the second half of the fiscal.

While the contribution from the top client was similar as previous quarters, a little weakness was visible in the 2-5 client bucket.

Attrition rate continues to remain high and stood at 16.5 per cent - a sequential increase of 140 basis points.

Outlook

With the new management (L&T) taking over, the company appears to be out of doldrums. The new CEO is trying to stabilise the business both in terms of gaining confidence of the clients and employees. However, acceleration of the growth momentum may have to wait a little longer. Seen in this context, the stock might have some downside, given the overall volatile macro and market environment. Such weakness could present a buying opportunity.

For more research articles, visit our Moneycontrol Research page

Disclaimer: Moneycontrol Research analysts do not hold positions in the companies discussed here

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!