Assets managed by the Indian mutual fund industry have grown 9.52 percent to Rs 25.81 trillion in June from Rs 23.57 trillion. Of this, the proportionate share of equity-oriented schemes was 42.3 percent of the industry assets in June, up from 41.2 percent in June 2018.

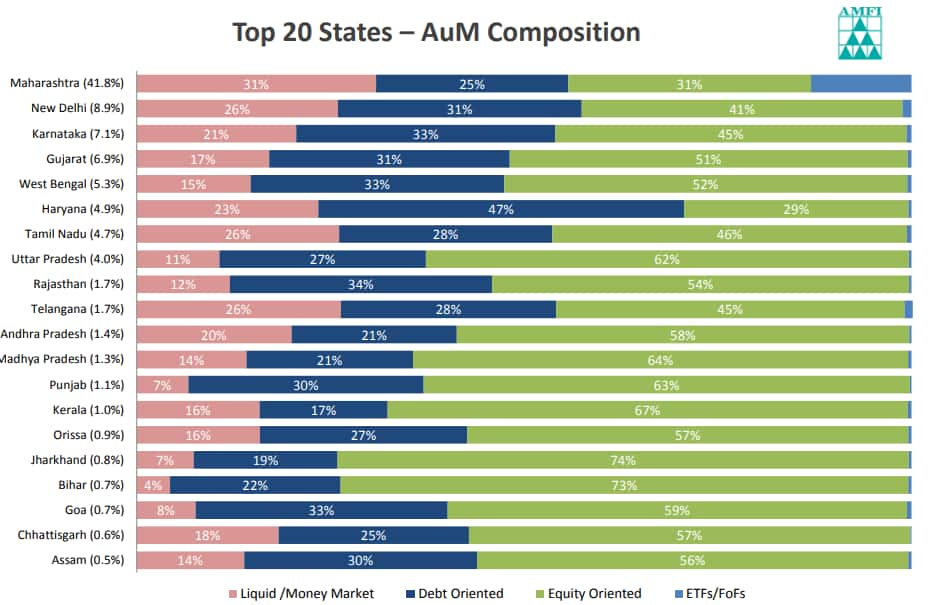

Data from the Association of Mutual Funds in India indicates that of the top 20 states, largest proportion (74 percent) of equity AUM contribution is from Jharkhand, followed by Bihar (73 percent).

“Investors from small states are largely retail investors and their goals are long-term like a wedding and education. They stay invested for the long term in equities and invest via SIPs,” Chandresh Pratap, a Mumbai-based distributor said.

Top 20 states include - Maharashtra, New Delhi, Karnataka, Gujarat, West Bengal, Haryana, Tamil Nadu, Uttar Pradesh, Rajasthan, Telangana, Andhra Pradesh, Madhya Pradesh, Punjab, Kerala, Odisha, Jharkhand, Bihar, Goa, Chattisgarh and Assam.

According to AMFI data, New Delhi and Maharashtra contribute 41 percent and 31 percent, respectively, to the equity AUM.

Composition of investor’ holdingsEquity-oriented schemes derive 88 percent of their assets from individual investors (retail + HNI), whereas institutional investors dominate liquid and money market schemes (85 percent), debt oriented schemes (53 percent) and exchange-traded funds and fund of funds (94 percent).

Individual investors primarily hold equity-oriented schemes while institutions hold liquid and debt-oriented schemes. Around 69 percent of individual investor assets are held in equity-oriented schemes and 77 percent of institutions assets are held in liquid/money market schemes and debt-oriented schemes.

In absolute terms, Maharashtra and New Delhi continue to remain the top two states having the highest proportion of the industry’s AUM. While Maharashtra held Rs 10.8 lakh crore, or 42 percent of industry’s total AUM, New Delhi held Rs 2.3 lakh crore, or 9 percent of the industry’s AUM.

Karnataka, Gujarat and West Bengal follow this list of having the highest AUM in absolute terms.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!