In the five state polls, the tide turned completely in favour of Congress indicating solid tug of war in the upcoming general elections 2019.

"One of the key takeaways from the election outcome is the strong comeback of Congress in the Hindi heartland belt, where the BJP had enjoyed unparalleled dominance for long," Motilal Oswal said.

Congress will form government in three key states as it made strong gains in Chhattisgarh and Rajasthan and managed to form government in Madhya Pradesh with support from others. Mizo National Front won in Mizoram and TRS retained Telangana with a thumping majority.

Interestingly, post 2014, Congress has emerged triumphant for the first time in a direct contest with the BJP in state polls, it added.

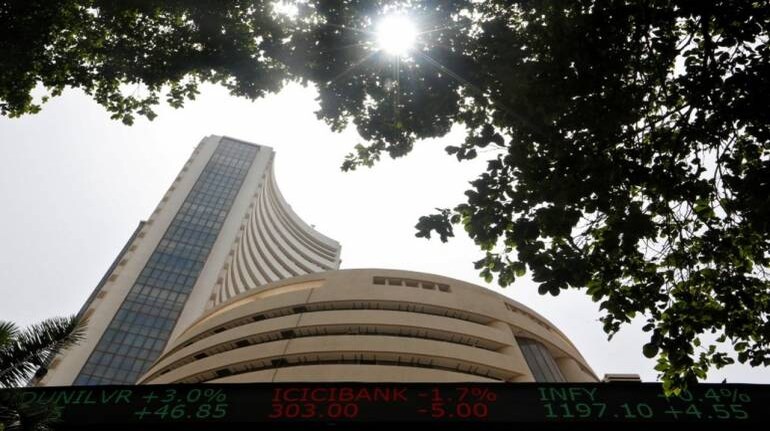

The market after elections results rallied sharply, gaining more than 600 points on December 12 in addition to nearly 200 points upside seen on December 11.

The formation of government by single party in every state could be one of reasons for rally as policy decision would be easier for them. Government's quick decision to appoint Shaktikanta Das as a RBI governor also lifted sentiment.

The research house said the other broader takeaway from the 2019 Lok Sabha election perspective pertains to Telangana.

TRS has swept the election with three-fourths majority, convincingly outperforming the grand alliance (Mahagathbandhan) of opposition parties. "This may result in several changes in the opposition's strategy of forging state-wise alliances," it said.

Hence, the research house expects an intense tug-of-war in the Lok Sabha polls, especially after the strong performance of Congress.

From a central government policy perspective, only 3-4 months are left before the Code of Conduct for general elections comes into force.

Motilal Oswal, thus, expects the government to turn incrementally more populist in its remaining term and provide relief/handouts to different segments of the electorate.

From the markets standpoint, as the hangover of state election results recedes, the research house expects the focus to revert to fundamentals, albeit with continued elevated volatility going into 2019.

Overall India’s macros have eased off since October 2018, with crude oil prices cooling off and currency along with bond yields rallying from their recent lows.

Brent crude futures, the international benchmark for oil prices, has corrected more than 28 percent from 2018 high touched in October. As India imports around 85 percent of oil requirement, this sharp fall is in favour of the country as well as companies which are dependent on this product.

From an earnings perspective, Motilal Oswal expects domestic cyclicals driven by financials to drive earnings in second half of FY19, taking over from global cyclicals which were driving earnings growth lately.

Hence its portfolio construction is biased toward largecaps and also names with strong earnings visibility, resilience to macro risks and reasonable valuations.

ICICI Bank, HDFC, State Bank of India, Maruti Suzuki, Titan Company, HUL, Infosys and L&T are its top ideas among largecaps.

In the midcaps, top picks are RBL Bank, TeamLease Services, Indraprastha Gas and Indian Hotels, Motilal Oswal said.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!