Anubhav SahuMoneycontrol Research

Benzene-based specialty chemical companies continue to deliver strong operating results aided by tactical factors like disruption in China production and structural improvement in cost competitiveness and technical prowess. Unlike other players in specialty chemicals, both these benzene value chain-based chemicals –- Seya Industries and Aarti Industries have exhibited improved margin owing to favourable supply demand dynamics, better product mix and vertical integration.

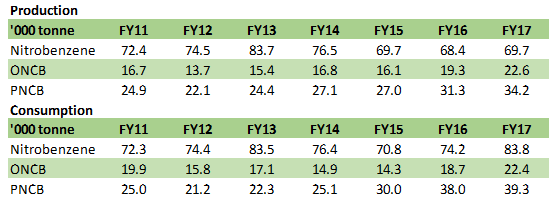

Improving domestic consumption trends for nitrochlorobenzene derivatives

Source: Ministry of Chemicals & FertilisersNote: PNCB - Para Nitro Chloro Benzene; ONCB - Ortho Nitro Chloro Benzene

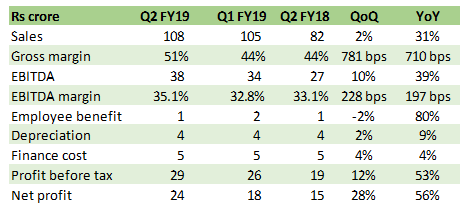

Q2 update: Seya IndustriesNet sales jumped 31 percent year-on-year (YoY) aided by better pricing realisations and higher volume of value added products. Gross margin expanded on better product mix and production disruptions in China. This supported earnings before interest, tax, depreciation and amortisation (EBITDA) margin expansion though partially offset by higher other expenses (increased fuel and power cost). It is noteworthy that EBITDA per tonne has expanded to Rs 74,897 per tonne from Rs 45,081 per tonne prevailing in FY18.

Result snapshot

Source: Company

Capacity expansion projects on track

The company is undergoing brownfield expansion of its key product, Para Nitro Aniline (PNA), which contributes about 20 percent to its current revenue (end markets: hair dyes). This expansion would double capacity to 8,000 tonne of PNA by FY19 end.

Its Rs 735 crore mega capacity expansion programme is expected to be completed by H2 FY20 and would lead to more than six times jump in final product capacity. Topline contribution from new capacity is expected to reach Rs 1,000–1,200 crore by FY23 at an optimum utilisation of 80 percent.

End-markets mix to change and so is margin profile

Seya Industries caters to end-markets of printing ink (49 percent), personal care and hair dye (14 percent) and pharmaceuticals (14 percent), which would likely undergo a change after mega capacity expansion plan. Meanwhile, the current brownfield expansion is expected to increase exposure of the hair dyes end-market.

After Phase II expansion, the margin profile in terms of EBITDA per tonne (excluding sulphuric acid sales) is expected to be in the Rs 33,000-35,000 per tonne range. This would be on account of new product additions which will have higher sales volumes but a lower unit sales price and margin per tonne as compared to existing products.

Among the upcoming products, diversification into sulphur trioxide-based specialty chemicals and dimethylsulphate is noticeable. This would have applications in pharma, preservatives in food industry, fabric softeners, agrochemicals etc. One interesting product which would be part of the company’s expansion plan is thionyl chloride (36,000 tonne). While this is popularly used as a precursor to dye intermediate (vinyl sulphone), here the company intends to use it for the lithium-ion rechargeable battery market.

Outlook

The lower end of the management's guidance implies a 33 percent revenue compounded annual growth rate (CAGR) over the next five years. EBITDA per tonne is expected to moderate due to product mix and normalisation in Chinese production disruptions (worst case: 10-15 percent margin impact), though partially offset by vertical integration benefits. Based on management inputs and our understanding 25-28 percent could be a sustainable operating margin in the long run, which would still be higher than prevailing specialty chemicals sector margins.

The management is hopeful that new capacity would be utilised at 45-50 percent in the first year of operation (FY21). However, opting to err on the side of caution, given the size of capacity and possible change in business dynamics in terms of end-markets, new products and clientele, we keep an assumption of 20 percent utilisation for new capacity in FY21. Assuming that the operating margin moderates to 31 percent, the stock is currently trading at 15 and 10 times FY20 and FY21 estimated earnings, respectively. While the ambitious capex plan by itself presents an execution risk, the project’s progress so far (67 percent completion) and debt/equity profile (peak expectation of 0.45) provides comfort.

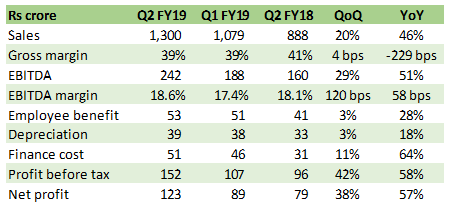

Q2 update: Aarti industries

Source: Company

Topline grew 46 percent YoY led by the pharma segment (15 percent of sales) and specialty chemicals (80 percent). The pharma segment exhibited 40 percent revenue growth with a focus on off‐patented generics and relatively higher share of exports (45 percent of division sales). Specialty chemicals witnessed revenue growth of 50 percent, partially aided by double-digit volume growth. Currency volatility impacted bottomline by Rs 22 crore as company had undergone forward contract hedging for its exports.

Capacity expansion in the benzene value chain

The management guides at a capital expenditure of Rs 700-1,000 crore annually over the next two years. The company has already raised a resolution to raise Rs 750 crore for the same. This includes investment towards multi-year contracts with the global agro-chemical companies, capacities debottlenecking and investment in downstream products.

The company is also setting up an R&D centre (Navi Mumbai) which is expected to start by Q1 FY20.

Outlook

In the next three years, the management expects double-digit volume growth (~15 percent) for specialty chemicals, partially aided by ramp-up in utilisation of nitrotoluene facility (40 percent in FY18) to optimum levels in FY19. In case of pharma segment, the company expects around 25 percent sales growth in FY19. Here earnings are expected to expand 40 percent in FY19 on the back of operating leverage.

Margin is expected to sustain on account of operating leverage as the utilisation improves for both pharma and specialty chemicals divisions and receding competition from China.

Overall, product pricing are expected to remain elevated due to improved demand in segments like dyes and pigments, herbicides, engineering polymers and pharma intermediates

The stock is trading at reasonable multiples (22/18 times FY20/21 estimated earnings, respectively) factoring in earnings CAGR (FY18-21e) of more than 23 percent. Higher multiple assigned by market participants takes account of global scale of operations, wider product offerings and stable revenue visibility on account multi-year contracts with some global chemical companies. The decision to hive off (by end of FY19) loss making home and personal care segment (5 percent of sales) also augurs well for valuation.

For more research articles, visit our Moneycontrol Research page

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!