Sachin PalMoneycontrol Research

Heidelberg Cement India continued its earnings momentum gained in Q1 and delivered a robust set of Q2 FY19 numbers. Strong volume growth, higher realisations and strict cost control measures aided operational performance in the quarter gone by. The stock continues to outperform its peers through superior business execution and therefore beckons the attention of long term investors.

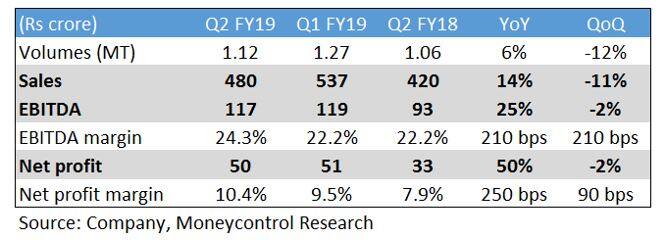

Another strong quarterSales and earnings before interest, tax, depreciation and amortisation (EBITDA) grew 14 percent and 25 percent year-on-year (YoY), respectively. Strong demand in the central region resulted in higher volumes (6 percent) and realisations (8 percent YoY). Operating leverage from higher capacity utilisation, cost benefits from its waste heat recovery system plant and change in fuel mix offset increased cost pressures and resulted in Q2 operating profit increasing Rs 117 crore.

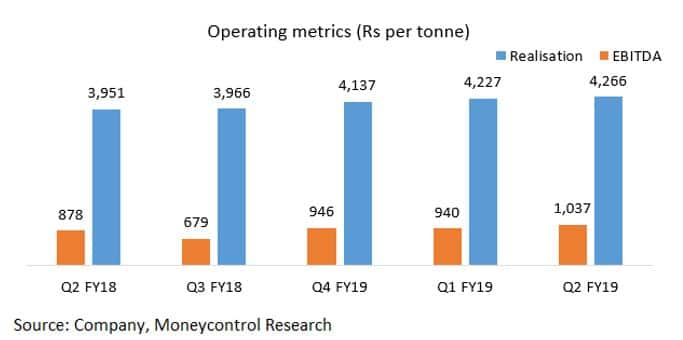

Realisations firm during the monsoon seasonThe monsoon had little impact on demand in a seasonally weak quarter for cement companies. Heidelberg operated at 82 percent utilisation in Q2 versus 90 percent in Q1 FY19. While volumes were slightly lower, prices in the central region remained firm for most part of the monsoon season. The company reported flat realisations on a sequential basis.

Heidelberg reported its highest ever EBITDA per tonne of Rs 1,041 in Q2 despite rising cost pressures. This translates to Rs 100 per tonne increase on a sequential basis. Its quarterly operating performance is particularly noteworthy as majority of industry players are facing margin compression owing to increase in input costs.

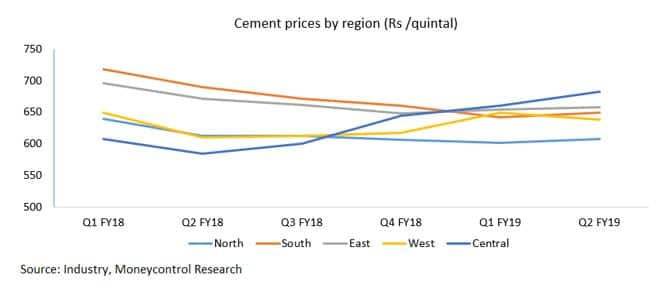

Competitive intensity to increaseCement prices across India were supported by higher prices at the end of June. Prices in most regions trended higher in July but corrected moderately (2-3 percent) in August and September.

Price uptrend in central region was aided by 75-78 percent capacity utilisation in the region. However, prices in most other regions continue to remain muted as companies prefer to chase volumes.

Higher prices in the central region vis-à-vis other regions is attracting supply from nearby areas. Change in demand-supply dynamics has resulted in increased competitive intensity, which could put a cap on further price increases within the central region.

The management said ongoing liquidity squeeze could result in some weakening of cement demand from infrastructure and housing segments. It expects to achieve a volume growth of 8-10 percent in FY19.

Outlook and recommendationCement demand continues to remain strong as most companies reported near double-digit volume growth in H1 FY19. Industry majors expect demand momentum to continue in the second half as well.

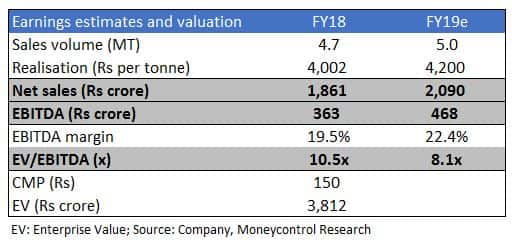

Heidelberg is our top pick from the midcap cement pack as the company has a strong positioning in the central market and superior margin profile compared to its peers. Firm cement prices in the central region and strong operating leverage is expected to aid earnings in the next few quarters. Its share price has been quite volatile in recent months and has seen a sharp recovery after the announcement of its Q2 result. The stock trades at an FY19 enterprise value/EBITDA multiple of around 8 times. Long term investors looking to add equity exposure in the midcap cement space can look forward to accumulate this stock on dips.

For more research articles, visit our Moneycontrol Research page

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!