The liquidity crisis at non-bank lenders and higher interest rates seem to have rattled chief financial officers (CFOs) of India Inc and resulted in their optimism to slip to a 19-quarter low.

Business information company Dun & Bradstreet polled 300 CFOs across all sectors to judge their optimism about financial health of their companies, business risk environment and macroeconomic scenario in the country.

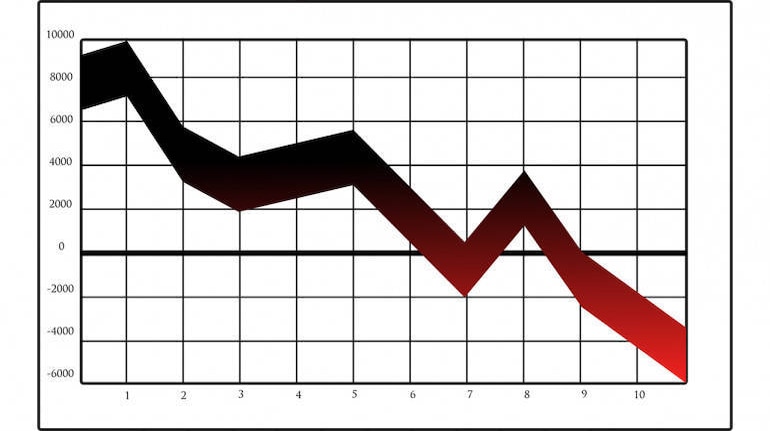

The composite CFO optimism index declined 17 percent in the last quarter of the year compared to the same period last year to 90.2, which is lowest in 19 quarters, it said.

Over 72 percent of CFOs polled said they expect availability of funds to decline or remain the same, the highest level in 27 quarters, the agency's managing director Manish Sinha.

The survey was carried out in September when the crisis at NBFCs was at its peak.

"This timing had an impact on CFO optimism levels, along with some other factors: cost and availability of funds and liquidity position of companies. The overall CFO optimism level reflects the rising borrowing costs and concerns over liquidity," he said.

Looking ahead, he said apprehensions over geo- political issues, rupee depreciation, input price pressures, events related to NBFCs and state and general elections are likely to weigh on the sentiment.

In the poll, optimism levels for financial performance is the lowest in 19 quarters while optimism levels for macroeconomic scenario is the lowest in 18 quarters.

The industrial sector has seen the highest level of lack of optimism at a 20-quarter low, while the same for service sector is at an 18-quarter low.

The survey said 45 percent CFOs feel level of financial risk for corporate sector to increase in Q4, which is also a 20-quarter high. Over half of them expect a fall or no change in their liquidity positions, 43 percent expect cost of funds to rise, 72 percent expect availability of funds to come down or remain same, it said.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!