Indian markets slipped in double-digits from their respective highs recorded in August and the best way to play the recovery is to invest in quality largecaps compared to midcaps, suggest global brokerage firms.

Macquarie has recently upgraded its Nifty50 target to 12,000 for March 2019. It expects largecaps to perform better than midcaps as the latter is still vulnerable from valuations and flows.

Macquarie expects Nifty to trade at 1-fwd PER of 16.6x, which is 10 percent above its long-term average PER of 15x. The global investment bank has upgraded its Nifty target to 12,000 for March 19 (based on 16.6x FY20E EPS).

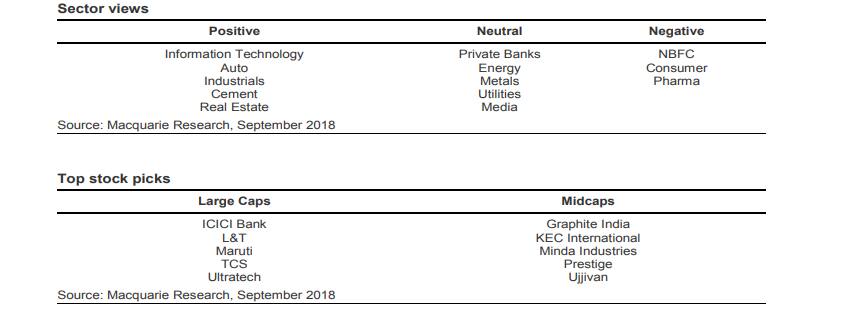

The global investment bank has downgraded private banks and metals to neutral from positive earlier, while it has upgraded auto to positive from neutral.

Macquarie expects Non-Banking Finance Companies (NBFCs) to underperform because the liquidity is likely to tighten significantly in the second half due to state and general elections, which usually lead to a high circulation of currency.

The global investment bank is positive on IT, Auto, Industrials, Cement, and Real Estate while negative on NBFC, consumer as well as pharma.

Top largecap picks include ICICI Bank, L&T, Maruti Suzuki, TCS and UltraTech Cements. In the midcap space, it fancies Graphite India, KEC International, Minda Industries, Prestige Estates, and Ujjivan.

Liquidity concerns regarding (NBFCs) amid worsening macro environment and weakening sentiment has driven equity markets lower in September and October.

The Nifty50 and Sensex are down 5.6 percent and 5.1 percent, respectively, in the first trading week of October. Including the 6 percent fall in September, the indices are down more than 10% from the recent highs. This has been one of the steepest declines in recent years.

One big factor which is pulling market lower is sharp sell-off by foreign institutional investors, suggest experts. “India, considered a relatively safe heaven a few weeks ago, is fast losing its sheen after the rupee plunged to a record low and crude oil prices soared to new highs,” Standard Chartered said in a report.

“The Indian market, which was a major outperformer until the first half of August, is now underperforming the MSCI EM (Emerging Market) in USD returns. The Nifty dollar returns YTD stood at a negative 12.7 percent, compared with the MSCI EM at 10.6 percent,” it said.

Foreign investors have been net sellers (equity) during September and the first trading week of October. The foreign investor sell-off intensified after a lull of two months as crude oil prices surged and as the rupee depreciated sharply against the US dollar on worsening trade deficit. FPIs have sold Indian equities worth Rs 9,470 crore in September and Rs 9,520 crore in the first week of October itself.

Standard Chartered has handpicked 10 stocks which are their top picks which include Maruti Suzuki, M&M, ITC, RIL, HDFC, HDFC Bank, ICICI Bank, L&T, Cipla, and HCL Technologies Ltd.

Disclaimer: The above report is compiled for information purposes only and is not buy or sell ideas. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!