Madhuchanda DeyMoneycontrol Research

Infosys posted a decent Q2 FY19 performance that saw steady execution, stable margin and strong deal wins. However, no change in FY19 revenue and margin guidance was a tad disappointing. Given the strong operating environment, it could well turn out to be a year of ‘under promise and over delivery’.

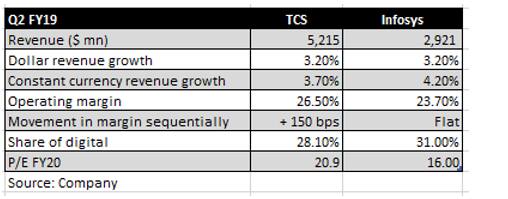

The commentary on order pipeline and financial services vertical was comforting. While the stock has handsomely outperformed in a weak market environment, we see the strategy of investing to be ‘digital ready’ to yield results gradually. Its large valuation discount to Tata Consultancy Services (TCS) is unlikely to narrow in the near future, but should move towards convergence once a favourable cycle kicks in. We derive comfort from the current undemanding valuation at 16 times FY20e earnings and feel there is enough headroom for upside should the management’s strategy yield expected results. The company’s generous payout policy and rupee depreciation could be the icing on the cake.

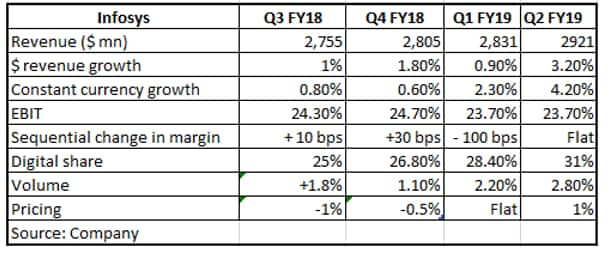

Quarter at a glance

Infosys reported a Q2 revenue of $2,921 million, a sequential growth of 3.2 percent in reported currency and 4.2 percent in constant currency. In line with peers, the digital business (31 percent of revenue) grew much faster at 13.5 percent sequentially and 33.5 percent year-on-year in constant currency.

While business from rest of the world handsomely outperformed the company average on a smaller base, the core market of North America (over 60 percent share) posted sequentially higher growth in Q2.

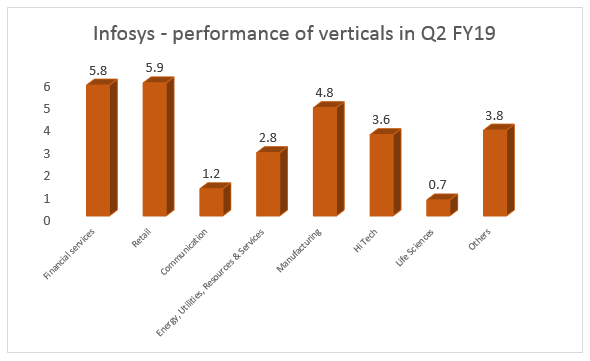

With regard to verticals, growth is becoming more broad-based. What was encouraging was the positive commentary on financial services, where the growth momentum is expected to sustain. Financial services and retail, with a total share of close to 49 percent, grew strongly. Performance of manufacturing and hi tech was also supportive. The soft spots were communication and life sciences and the management expects weakness in the latter to continue for a while.

Source: Company

Source: Company

Why stability and not an improvement in margin?At the beginning of the fiscal, the management had guided to a lower operating margin band of 22-24 percent on account of stepping up of investment in areas to enhance its digital capabilities. In Q2, it reported an operating margin of 23.7 percent, the same as the previous quarter.

Infosys implemented wage hike for its remaining (15 percent) senior employees in Q2. This impacted margin negatively to the tune of 100 basis points (bps). In order to cater to contracts on the digital side, which required niche skill set at a short notice, the company had to step up sub-contracting. This, along with other expenses to counter attrition, higher spend in local markets and investments impacted margin negatively by 50 bps. These were countered by an 80 bps benefit on account of rupee depreciation and 70 bps due to pricing gains, lower onsite mix and visa expenses.

The company expects to boost investments in the second half, but is hopeful of a reduction in its sub-contracting expenses.

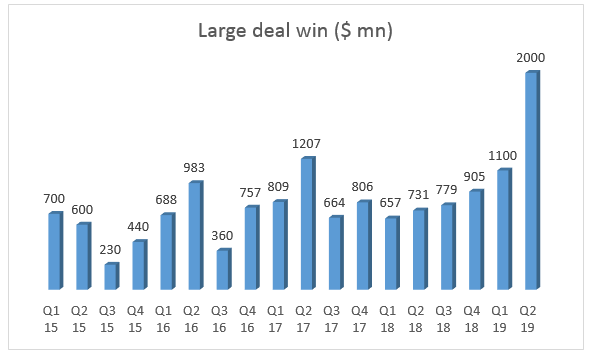

Strong deal winsThe key highlight for the quarter gone by was the $2 billion deal win. The management commentary is positive on the demand environment with no overt concern coming from any key vertical or geography. The management reported 12 large deal wins in financial services, manufacturing and hi-tech. Seven deals were from US, four from Europe and one from the Rest of the World.

Source: Company

Source: Company

While we are concerned with the high attrition (19.9 percent), net employee addition remains strong and points to a better demand environment. Although the high utilisation rate limits near term margin upside, especially since planned investments would accelerate and seasonality will play out in the near term, we see structural upside to margin from higher share of digital (with higher gross margin) and deployment of the pyramid structure onsite (with stepping up pf local hires). Cyclically, further weakening of the Indian currency could act as an opportunity.

Though revenue per employee is inching up, it is not yet suggestive of a level expected from a pure digital company and this is a matrix that we would like to monitor closely.

Infosys has undertaken a few acquisitions which should start contributing. But despite this, the revenue guidance for FY19 has been retained at 6-8 percent and operating margin guidance at 22-24 percent. It remains to be seen if it turns out to be a year of ‘under promise and over delivery’.

What to expect from the stock?We expect a slow and steady growth trajectory for the company. The valuation gap with bellwether TCS, therefore, is unlikely to narrow in a hurry. However, its payout policy is now well-defined (at least 70 percent of free cash flow) and remains generous at a pre-tax yield of over 3 percent.

A stable senior leadership, well chalked out execution strategy, better demand environment, generous payout and weaker rupee protects downside for the stock. The valuation too looks undemanding at 16 times FY20e earnings. Hence, Infosys is an ideal stock for investors with an eye on the long term.

A stable senior leadership, well chalked out execution strategy, better demand environment, generous payout and weaker rupee protects downside for the stock. The valuation too looks undemanding at 16 times FY20e earnings. Hence, Infosys is an ideal stock for investors with an eye on the long term.

For more research articles, visit our Moneycontrol Research page

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!