Nitin AgrawalMoneycontrol Research

As the quarterly earnings season kicks off, more often than not larger companies get disproportionate attention of investors/analysts, and at times the lesser -known gems go unnoticed.

Our endeavour, therefore, was to companies that posted a strong set of numbers for the quarter ended December 2017 and should, therefore, be on the radar of investors.

The first company on the list is Prakash Industries, which is one of the largest integrated steel manufacturers in India with 1.2MT per annum of integrated steel capacity and 230MW of the captive power plant.

The company posted strong set of numbers on the back of highest sales realization with domestic steel and ferro alloys prices witnessing a steep rise of more than 20% in 3QFY18. Growth in sales volume and higher capacity utilization also aided performance.

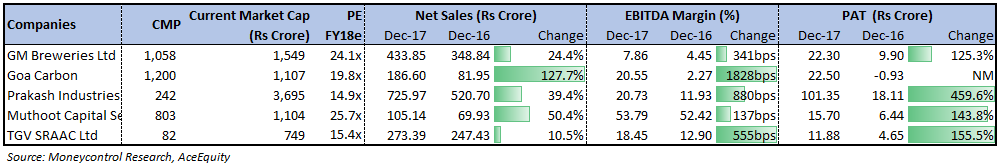

Consequently, net sales grew by 39.4 percent and EBITDA margin expanded by 880bps when compared to the same period last year.

The company now plans to expand its integrated steel plant capacity to 3 MT tonnes p.a. over the next 5 years in a phased manner and the management is confident of making the company debt free in next two years (reduced debt by Rs160cr in 9MFY18).

From the consumption space, the company that reported interesting number was GM Breweries, which is a manufacturer and marketer of alcoholic beverages; such as Country Liquor (CL) and Indian made Foreign Liquor (IMFL). The company is the single largest manufacturer of country liquor in the State of Maharashtra with a capacity to process 13.76 crore bulk litres of country liquor per annum.

Despite the ban on alcohol sales on highway, GST and prohibition of alcohol in a few states, the company posted a very strong set of numbers with net sales growing by 24.4 percent and EBITDA margin witnessing an expansion of 341 bps, primarily because of the 354 bps fall in the raw material prices as percent of net sales.

Another company that caught our attention is Goa Carbon, which is a manufacturer and marketer of Calcined Petroleum Coke (CPC) with a capacity of 2.4MT per annum. The company is the second largest manufacturer of CPC in the country.

Goa Carbon is riding well on the tailwinds coming from growing demand for aluminium and steel in the country. Net sales witnessed a significant growth of 127.7 percent and its EBITDA margin expanded by 1828 bps (year-on-year). The strong numbers came in, primarily, on the back of better realizations. The company posted a profit-after-tax (PAT) of 22.5 crore in this quarter as compared to the loss of 0.93 crore in the same quarter last year.

The management, however, indicated the company can witness an increase in the cost of goods due to higher raw material prices, going forward. He also mentioned the company can go for acquisition to increase capacity as the capacity utilization was 100 percent for this quarter.

Muthoot Capital Services, which is a Non-Banking Finance Company (NBFC) has a good presence in rural and semi-urban areas in southern India and is engaged in financing for purchase of automobiles, including two wheelers, against hypothecation of the respective vehicles, and granting of personal/business loans against demand promissory notes. The company is also engaged in buying loan portfolios from other NBFCs financing the two wheelers/small business/micro finance sector.

The company posted 155.5 percent growth in PAT aided by 68 percent rise in net interest income (NII), reduction in operating expense and a decline in credit costs.

Despite operating in an intrinsically profitable business (commanding high return on assets) the business suffered due to higher delinquency. The quarter witnessed a significant decline in credit costs to 1.5 percent from 2.2 percent in FY17.

In fact the gross NPA (GNPA) and net NPA (NNPA) stood at 5.5 percent and 4 percent respectively, down from 7.7 percent and 5.6 percent in same quarter last year.

The company currently has gross AUM (assets under management) of Rs 1,979 crore, up 56 percent (yoy). It has recently raised Rs 165 crore through qualified institutional placement (QIP) to participate in the growth opportunities. The stock trades at 3.8X trailing book.

The last company in the list is TGV SRAAC (erstwhile Sree Rayalaseema Alkalies), a leading producer of Chlor-Alkali products and manufactures castor derivatives and fatty acids. The company has installed capacity of 156,950MT p.a. for caustic soda, 23,100MT p.a. for Potassium Hydroxide and 41,250MT p.a. for Chloromethane.

TGV is riding well on the tailwinds from Chlor-Alkali industry. While the company has posted a growth of 10.5 percent in net sales, its EBITDA margin expanded by 555 bps points on the back of fall in the raw material prices, which got partially offset by rise in operating & manufacturing expenses and electricity, power & fuel Cost. The company’s PAT witnessed a growth of 155.5 percent.

For more research articles, visit our Moneycontrol Research Page.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!