Kunal Bajaj

Starting Jan 1, 2013, every Mutual Fund in India comes in two flavors – a 'Regular Plan’ and 'Direct Plan'. They are the exact same scheme, run by the same fund managers investing in the same stocks and bonds, but with one difference...

The Regular Plan Costs you much more!

A Regular Plan is one in which the Mutual Fund Company pays your broker back a hidden percentage of commission every quarter. This commission comes out of your investments, although you never ever write a cheque for it.

But when you buy a Direct Plan instead, no commissions are paid to anyone. The commissions which were not paid to your broker are instead ADDED to your investment balance at the Mutual Fund.

Different NAVs and Different Returns

A Regular Plan and Direct Plan of the same Mutual Fund Schemes will each have a different expense ratio (annual cost of owning the mutual fund scheme). The expense ratio of Direct Plans is lower on account of the savings in commissions paid out to brokers.

This savings in commissions is added to the returns of the scheme – and passed on to you, the customer, in the form of a higher Net Asset Value (NAV) each day!

And so the NAV of Direct Plans is relatively higher than Regular Plans. This does not mean that Direct plans are more expensive! Instead, this means that Direct Plans have given you better returns on your savings and the NAVs have grown higher.

My investment advisor tells me these commissions don’t matter in the long run?

Your agent will probably tell you that it doesn’t really matter which plan you invest in. After all, he only earns a small fee for his services.

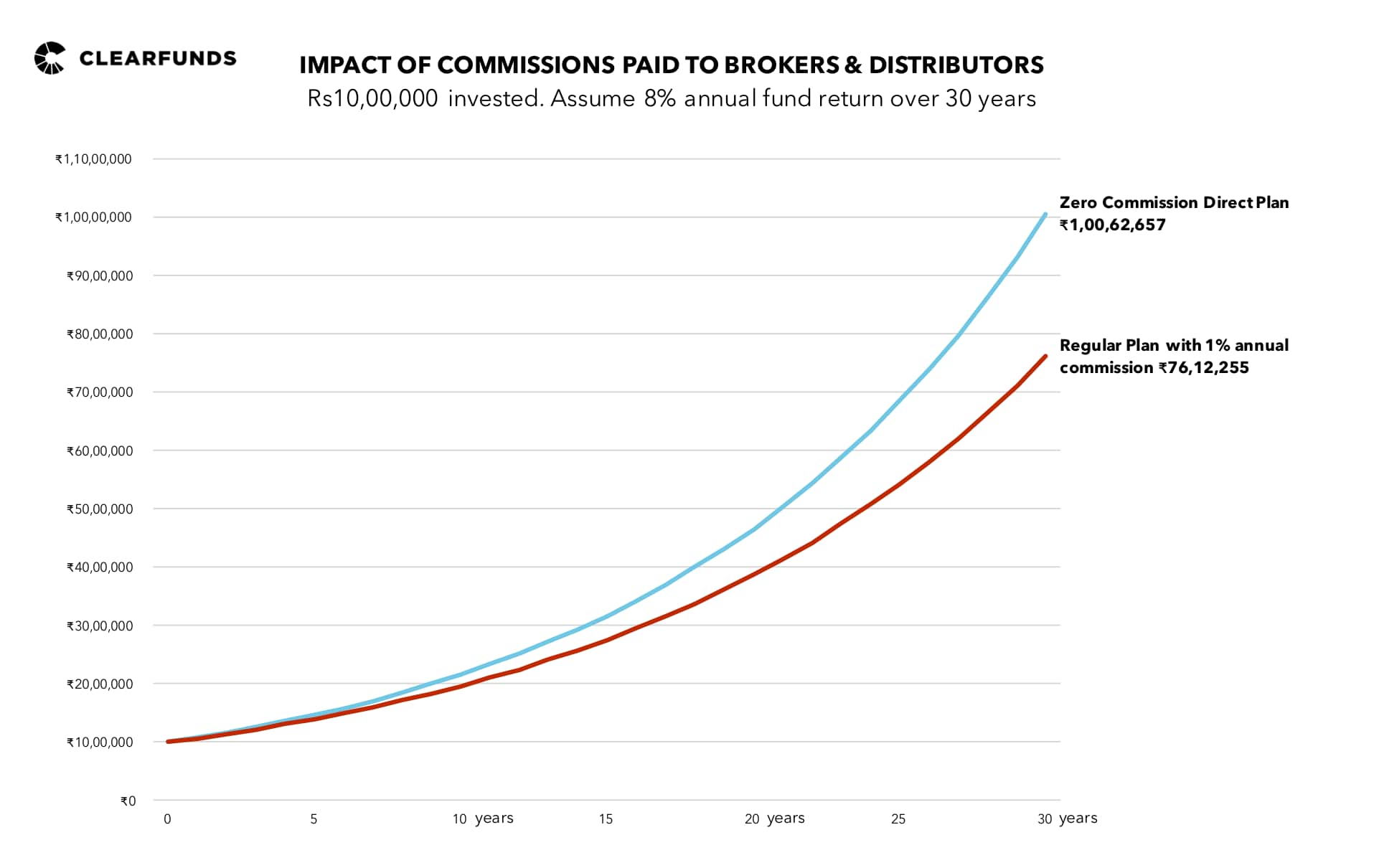

But that small fee adds up to a lot! Take the case of a 35-year- old investor putting Rs 10 lakhs in a Regular Plan of a Mutual Fund, which grows at 8 percent a year (less 1 percent commission). When he retires at age 65, this investment would be worth Rs 76 lakhs.

On the other hand, if he switched to a Direct Plan of the exact same Mutual Fund an eliminated this 1 percent annual commission, his retirement pot would become Rs 1 crore over the same period.

In other words, by buying a Regular Plan, a quarter of your hard-earned retirement savings could wind up in your broker’s pocket. You could have spent that on your kids, but instead your broker gets to spend your money on his kids.

When you're looking to invest your savings into Mutual Funds, you should look for an investment advisor that truly works in your interest. Most good advisors thes days will not sell or recommend Regular Mutual Funds because these end up costin you a recurring, hidden brokerage fee, year after year, forever.

I’ve already invested in Mutual Funds. Did I buy a Direct or Regular plan?

The simplest way to know this is to check your statement. If your scheme name says Regular, you have invested in a regular plan. Or just think about how you invested in Mutual Funds in the first place:

If you have invested through your bank, you have invested in a regular plan and are paying hidden brokerage.

If your agent is not charging you anything or tells you his advice is for 'free,' you have invested in a regular plan and are paying hidden brokerage.

If your agent says he gets paid by the mutual fund company, you have invested in a regular plan and are paying hidden brokerage.

If your bank/broker/agent/distributor/advisor has not told you explicitly about which plan you are investing in, you have invested in a regular plan an are paying hidden brokerage.

How do I buy a Direct Plan?

Until recently, buying a direct plan was far from simple. You had to register at the mutual fund companies websites, remember tens of passwords and do your KYC every time you invest in with a new mutual fund company.

But now, online investment advisers offer the convenience of one-time registration, recommend the best possible funds and allow you to buy any direct mutual fund in India.

So switch to a direct plan and stop working to send your broker’s, banker’s or agent’s kids to study abroad. Make your hard-earned money work for your family, not his.

Author is Founder & CEO of Clearfunds.com

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol are their own and not that of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!